COVID-19: RBI’s Emergency Healthcare Measures

STORIES, ANALYSES, EXPERT VIEWS

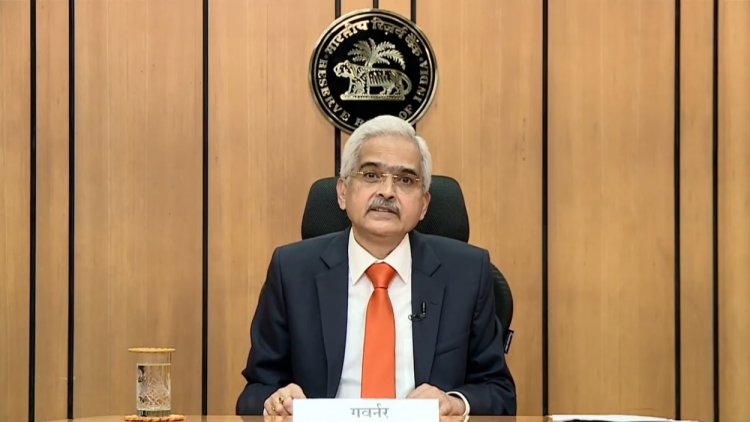

The Reserve Bank of India Governor Shaktikanta Das Wednesday, announced a Rs 50,000 lending programme stating that COVID-19-related healthcare infrastructure will be ramped up. "Will ramp up COVID-related healthcare infra," he said adding that on-tap liquidity window of Rs 50,000 crore with up to 3-year tenor at repo rate is being opened until March 31, 2022.

The Governor said that under the scheme, banks can support entities including vaccine manufacturers, medical facilities, hospitals and also patients. Banks will now be able to lend to COVID-19 patients who need money for treatment. This lending will get priority sector classification till repayment or maturity. The window for such loans will remain open till March 31, 2022.

Pursuant to the RBI announcement, the Bank of Baroda has immediately released a loan of INR 500 crore to the Serum Institute of India - manufacturer of the Oxford/AstraZeneca vaccine

Growth prospects change

Stating that India was poised for growth at the turn of the year, the Governor said the situation has drastically changed now. Impact on demand however, will be moderate because businesses have learnt to survive despite restrictions and containments. A good monsoon expectation will keep rural demand strong. Aggregate supply conditions prevail underpinned by strength of agriculture sector.

RBI does not expect any broad deviations from inflation projections made in April and that domestic financial conditions remain easy owing to ample liquidity.

Highlights

— On-tap liquidity of Rs 50,000 crore at repo rate. Under this, banks can support healthcare stakeholders like vaccine makers, hospitals, medical equipment makers as well as patients till March 31, 2022.

— Till repayment or maturity, such lending will be considered priority sector lending. Under this scheme, a special loan book will be created by banks.

— Banks can park liquidity equal to their Covid loan books at 40 basis points above the reverse repo rate.

— A targeted long term repo operation up to Rs 10,000 crore will be started for small finance banks. The upper limit is Rs 10 lakh per borrower.

— Small finance banks can now on-lend to smaller MFIs of asset size up to Rs 500 crore.

— The RBI will allow states to remain in overdraft for a maximum of 50 days. The limit was 36 days earlier. Besides, the number of consecutive overdraft days will go up to three weeks from two weeks earlier. This facility pertains to funds under the Ways and Means Advances.

— Individuals and MSMEs borrowers can avail one-time restructuring till September 30, 2021. This covers those having exposure up to Rs 25 crore, and those that were standard as of March 31 this year.

— The moratorium period under restructuring 1.0 can now be extended up to 2 years.

RBI joins fight against Covid-19

The Reserve Bank of India, writes The Hindu has joined the fight against the pandemic “through the announcement of measures aimed at alleviating any financing constraint for those impacted, including the health-care sector, State governments and the public……. Stressing that it is imperative to both save lives and restore livelihoods, Mr. Das proposed a calibrated response, mooting a ₹50,000 crore term liquidity facility to boost credit availability for ramping up COVID-related health-care infrastructure and services. Lenders have been urged to expedite lending under this ‘priority sector’ classified scheme to entities including vaccine manufacturers, hospitals, pathology labs, suppliers of oxygen and ventilators, importers of COVID-related drugs and logistics firms. And although Mr. Das said the scheme would also cover patients requiring treatment, he failed to spell out how those most in need of financial assistance to cover their surging medical bills could borrow the funds. In directing the flow of credit to the sector most in focus at the moment, the RBI has signalled it is cognisant of the burden on health-care and allied providers. However, how much lending capital-stressed banks would be willing to write into their ‘COVID loan books’ remains to be seen.”

Direct support to healthcare sector will generate total output demand of Rs 80,000 crore: SBI Research According to SBI's Research report, measures unveiled by the Reserve Bank of India, including the announcement of a Rs 50,000 crore special liquidity window to address the needs of the healthcare sector, will go a long way in supporting it. The report said the macro impact of the scheme can be gauged from the fact that "Rs 50,000 crore is roughly 9% of India's total health expenditure of Rs 6 lakh crore under private final consumption expenditure in 2019-20."

It further added that a direct support to the sector will generate "total output demand of roughly Rs 80,000 crore."

The report noted the sectors that will benefit from the central bank's on-tap liquidity window comprise rubber plastics, organic chemicals among others where the limit utilisation is close to 55%.

The report also flagged some concerns "evident on inflation on inflation from the statement, predominately emanating from spike in global commodity prices."

However, it highlighted the loss on account of the second wave is likely to be lesser as business resilience in the wake of the disaster has improved since last time. "Businesses have learnt to survive despite Covid restrictions and containments. The measures today are largely addressed to the health sector and dedicated funding has been extended to the sector," the report stated.