Monetary Policy Committee (MPC) Meeting: Focus on Inflation

STORIES, ANALYSES, EXPERT VIEWS

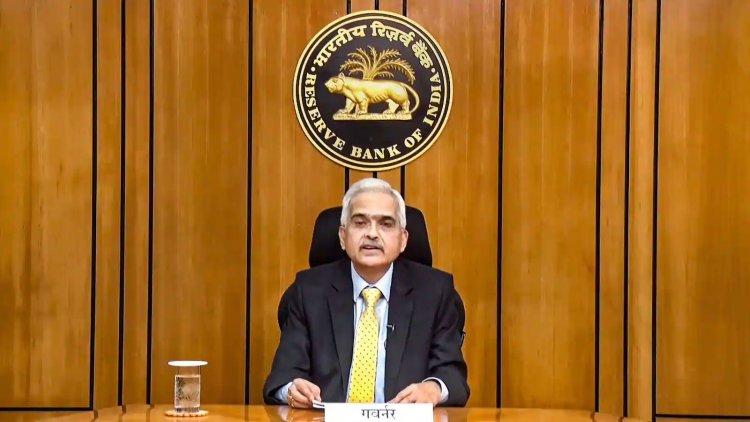

At the end of its three day meeting last week, the Reserve Bank of India (RBI) Governor Wednesday announced that the Monetary Policy Committee (MPC) voted unanimously to hike the benchmark interest rate by 50 bps with immediate effect. The RBI also left its FY23 GDP growth forecast unchanged at 7.2%.

The policy repo rate now stands at 4.90%, still below its pre-pandemic level. Standing Deposit Facility (SDF) and Marginal Standing Facility (MSF) rates have been raised by 50 bps. SDF rate stands adjusted to 4.65%, MSF rate adjusted to 5.15%.

Inflation, a worry

The RBI saw inflation higher at 6.7% for the current fiscal year from 5.7% projected earlier, while retaining gross domestic product (GDP) growth at 7.2% for 2022-23.

Under Indian laws, if inflation hovers above 6% for three straight quarters, the RBI must explain to the government the reasons for failing to meet its inflation target and recommend remedial actions.

The aggressive stance of the RBI on increasing repo rate comes amid a grim prognosis of geo-political uncertainties over the grinding war in Ukraine, continuing supply-chain disruptions, and rising energy and food prices. Consumer prices accelerated to an eight-year high of nearly 7.8% in April, according to official data.

The MPC sees clear risks from runaway prices to the economy. “The Ukraine war has led to globalisation of inflation,” RBI Governor Shaktikanta Das said. Emerging economies, such as India, were facing “bigger challenges” because of shifting monetary policies of advanced economies, which were impacting markets, he added. The MPC noted that inflation risk has intensified further.

Factors clouding the inflation outlook include elevated commodity prices as a result of the Ukraine war, the heat wave stunting the wheat crop output, high edible oil prices, crude prices that continue to pose a pass-through risk to domestic pump prices of fuels, increases in electricity tariffs, and, crucially, manufacturing and services firms flagging input and output price pressures.

Inflation to average 6.8 per cent this fiscal: In his analysis, Dharmakirti Joshi (Chief Economist at CRISIL) expects “inflation to average 6.8 per cent this fiscal. The risks to the forecast are still tilted upwards as all the key components of CPI — food, fuel and core — show no signs of relenting. The pressure on food inflation has increased owing to the impact of the freak heatwave on wheat, tomatoes and mangoes, which is driving prices higher. This is on top of rising input costs for agricultural production, the global surge in food prices and the expected sharper than usual rise in minimum support price. Fuel inflation will remain high, duty cuts notwithstanding, as global crude prices remain volatile at elevated levels.” The future concern is that services inflation is likely to rise further.

Fiscal measures: Not all aspects of supply-driven inflation can be addressed via monetary policy. So the authorities are complementing monetary policy actions by using the limited fiscal space to cut duties and extend subsidies to the vulnerable. Despite these measures, consumer inflation is unlikely to print below 6 per cent (upper band of the RBI’s target range) before the last quarter of this fiscal year which incidentally is the RBI’s projection as well.

Real GDP forecast unchanged at 7.2% for FY23

The RBI retained its GDP growth forecast at 7.2 for the current fiscal but cautioned against negative spillovers of geopolitical tensions and a slowdown in the global economy.

Governor Das said the available information for April and May 2022 indicates that the recovery in domestic economic activity remains firm, with growth impulses getting increasingly broad-based.

Manufacturing and services purchasing managers' indices (PMIs) for May point towards further expansion of activity. This is also corroborated by the movements in railway freight and port traffic, domestic air traffic, GST collections, steel consumption, cement production and bank credit. While urban demand is recovering, rural demand is gradually improving, Das said.

Governor Das stated that an increase in contact-intensive services is expected to lead the urban consumption. The rural demand is likely to improve gradually with an improvement in the agricultural sector and the likelihood of a normal southwest monsoon season.

"Looking ahead, real GDP is expected to broadly evolve on the lines of the April 2022 MPC resolution. The forecast of normal south-west monsoon should boost ‘kharif’ (monsoon crops) sowing and agricultural output.

"This will support rural consumption. The rebound in contact-intensive services is expected to sustain urban consumption," he said.

Nevertheless, Das noted that the negative spillovers from geopolitical tensions; elevated international commodity prices; rising input costs; tightening of global financial conditions; and a slowdown in the world economy continue to weigh on the outlook.

"Taking all these factors into consideration, the real GDP growth for 2022-23 is retained at 7.2 per cent, with Q1 at 16.2 per cent; Q2 at 6.2 per cent; Q3 at 4.1 per cent; and Q4 at 4.0 per cent, with risks broadly balanced," the governor said.

India's economy grew by 4.1 per cent in the January-March quarter of 2021-22.

The governor further said experience teaches that preserving price stability is the best guarantee to ensure lasting growth and prosperity.

GDP projections by global agencies: The World Bank had recently revised its economic growth estimate for the second time to 7.5% from 8% for FY23.

Global rating agencies like Moody's Investors Service, S&P Global Ratings, Fitch, and Asian Development Bank (ADB) have brought down their GDP projections considering factors like early heat waves in March, import-export bans and shortage of raw materials.

The International Monetary Fund (IMF) had lowered its economic predictions for India, stating that it expects the country's growth rate to be approximately 8.2% instead of the previously predicted 9%. Following the suit, the Asian Development Bank (ADB) had also predicted the growth to fall to 7.5%.

Lowering their expectations by a few percentage points due to high crude oil prices, the RBI in April had cut the forecast to 7.2% from 7.8%.

However, the government has been trying to enhance the economic activity of the country by proposing to increase capital expenditure by 35.4% to Rs 7.5 lakh crore or 2.9% of the GDP .

Finance minister Nirmala Sitharaman also said that the economic growth will be supported by investment in public funds along with a push for business investment, imparting momentum to the economy based on the concept of growth at both a macro and micro level which complements each other.

Withdrawal of accommodative policies to fuel growth

The two successive rate hikes point to a clear withdrawal of the RBI’s accommodative policies to fuel growth. The central bank slashed the repo rate in March 2020 to push nascent economic recovery after the impact of the Covid pandemic.

The RBI kept two benchmark economy wide interest rates unchanged at record lows for almost two years before increasing them on May 4, 2022, a signal that the central bank at the time continued to prioritise growth recovery despite inflationary winds sweeping the world.

The repo rate refers to the rate at which commercial banks borrow money by selling their securities to the Reserve Bank, while the reverse repo rate is the rate at which the central bank borrows money.

These rates are key to boosting credit and investments by businesses. The MPC’s review of the economy is critical for markets and general business sentiment.

The forecast of a normal monsoon will help to ease inflation concerns, the RBI governor said, adding that the repo rate still remained below pre-pandemic levels.

Post MPC meeting press conference by RBI Governor

Addressing a press conference, RBI Governor Shaktikanta Das said future policy actions by the central bank will be guided by the evolving conditions.

On accommodative stance: The governor said the RBI has changed the policy stance to drop the phrase "remains accommodative", and instead opted for "withdrawal of accommodation" for guiding its future moves.

Cash reserve ratio not increased: The central bank did not hike the cash reserve ratio contrary to speculation, he said, adding that the liquidity withdrawal will be calibrated and measured. He assured that adequate liquidity will be available for banks to lend for economic growth.

Economy continues to be resilient: The Indian economy continues to be resilient and is well placed to deal with challenges emerging from the global worries and will be supported by a banking system having strong capital buffers, low non-performing assets and higher provisioning coverage, Das said.

Confident on containing inflation: At a time when the RBI upped its inflation expectation to 6.7 per cent, the governor said he is confident that the actions being taken by the central bank will help reduce inflation and also inflationary expectations among the people. He assured that the RBI does not want to take any abrupt or rough action that will be detrimental to inflation and the markets.

Move will impact growth

RBI governor Shaktikanta Das’s acknowledgement that 75% of the increase in the latest inflation forecast is due to food, says Swaminathan S. Anklesaria Aiyar (economist, journalist, and columnist; consulting editor for the Economic Times) “merits the question -- will the interest rate hike slam the brakes on rising inflation as it is mostly driven by food and fuel?

"In India in particular, everybody knows that if you raise interest rates, it cools inflation by slowing down the economy and saying demand is going down but if the particular inflationary shock has been caused by things like food and fuel, those are not highly sensitive to interest rates. Economic growth may be a little more sensitive than food and fuel."

Aiyar says that the aim of raising interest rates is to slow down the economy and it would be naïve to think that growth won't be affected.

Moves like the recent tax cuts by the government have a more immediate impact on cooling of prices of food and fuel. "There are different arrows in the government’s quiver for solving inflation like changes in duty structure or changes in the import export policy," Aiyar says.

He added that the RBI raising interest rates will not help solve the problem of food and fuel. "RBI raising interest rates is an attempt of a much larger economy overall to try and cool down demand. These two (interest rate hike and duty cuts) should not be confused and the Reserve Bank is not going to solve the problem of food and fuel."