Monetary Policy Review: RBI Keeps Policy Rate Unchanged

The Reserve Bank of India's Monetary Policy Committee (MPC) Friday kept repo rate unchanged at 4 per cent for the fourth time in a row, while reverse repo rate was also kept unchanged at 3.35 per cent.

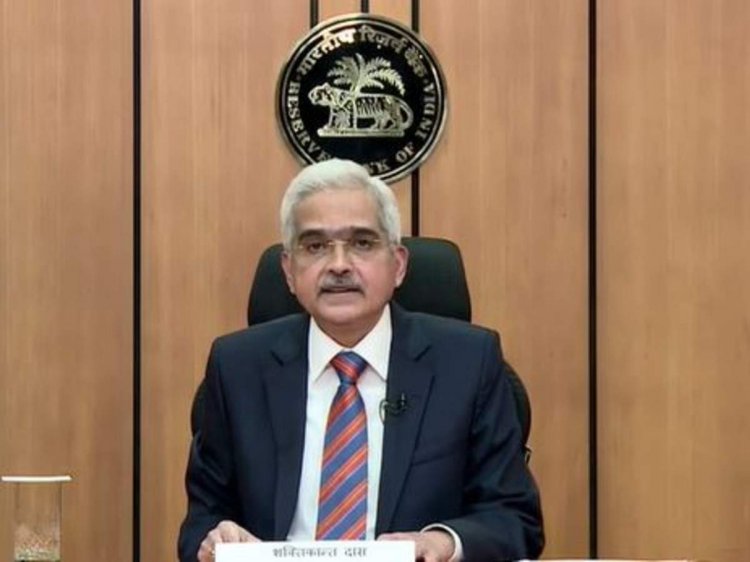

The central bank will maintain an accommodative monetary policy stance, at least through the current financial year and into the next year, to support growth, mitigate the impact of COVID-19 pandemic, and keep inflation at the targeted level, Reserve Bank of India (RBI) Governor Shaktikanta Das said.

The Governor announced a two-phase restoration of cash reserve ratio (CRR) for banks to 4 per cent. CRR will be restored to 3.5 per cent from 3 per cent currently effective from March 27, 2021 and to 4 per cent from May 22, 2021.

Positive outlook on growth

Saying that the outlook on growth has turned positive and signs of recovery in the economy are strengthening further, Das projected 10.5 per cent GDP growth for 2021-22. "Consumer confidence is reviving and business expectations of manufacturing, services and infrastructure remain upbeat. The movement of goods and people and domestic trading activities are growing at a robust pace," he said.

The projection is in line with the estimates in the Union Budget 2021-22. The Economic Survey, tabled by the government in Parliament recently, has projected that the economy will grow at 11 per cent, up from an estimated historic decline of 7.7 per cent in 2020-21, on account of the COVID-19 pandemic.

The Governor said the Union Budget 2021-22, has provided a strong impetus for revival of sectors such as health and well-being, infrastructure, innovation and research, among others. This, he said will have a cascading multiplier effect going forward, particularly in improving the investment climate and reinvigorating domestic demand, income and employment.

Resilient Demand: The monetary policy statement said rural demand is likely to remain resilient on good prospects of agriculture. Urban demand and demand for contact-intensive services is expected to strengthen with the substantial fall in COVID-19 cases and the spread of vaccination.

Consumer confidence, it said is reviving and business expectations of manufacturing, services and infrastructure remain upbeat. "The fiscal stimulus under AtmaNirbhar 2.0 and 3.0 schemes of government will likely accelerate public investment, although private investment remains sluggish amidst still low capacity utilisation," it added.

Inflation

The Reserve Bank lowered the retail inflation projection for the current quarter of this fiscal at 5.2 per cent, saying it has returned within the "tolerance band". On the economy, the central bank said it is only going to look upwards from here.

Das said the retail inflation has "returned within the tolerance band" of 4 per cent. The Reserve Bank has the mandate to keep retail inflation at 4 per cent with a bias of plus/minus 2 per cent on either side.

The inflation (retail) projection is revised to 5.2 per cent for Q4 of the current fiscal, Das said, adding vegetable prices are likely to remain soft in near term on the back of fresh arrivals in the market.

In its previous policy decision in December, the RBI had projected retail inflation to be at 5.8 per cent for Q4 FY'21.

For the first half of the next fiscal year, the Reserve Bank has projected inflation to be in a band of 5.2-5 per cent.

And for the third quarter of 2021-22 (October-December), Das said: "We are projecting it (inflation) at 4.3 per cent. We are assessing the risks to be balanced”.

New incentives for commercial banks to lend to MSMEs

To incentivise new credit flow to MSME borrowers, RBI announced measures that could ease credit for MSME entrepreneurs. “Scheduled commercial banks will be allowed to deduct credit disbursed to new MSME borrowers from their NDTL for calculation of CRR,” Das said.

Das further added that for the purpose of this exemption, new MSME borrowers would be those who have not availed any credit facilities from the banking system as on 1st January 2021. “This exemption will be available for exposures up to Rs 25 lakh per borrower for credit extended up to the fortnight ending Oct 1st, 2021,” he added.

The move will facilitate more fund flow for a sector which has been facing acute financial crunch in the aftermath of the pandemic. This follows Budget announcement of doubling the allocation for MSMEs this year to Rs 15,700 crore.

K R Sekar, Partner, Deloitte India says that this is a step in the right direction for the sector. "MSMEs will have more access to formal banking credit and it will help address their financial requirements. Moreover, there has been an increased government spend in the Budget on three sectors - infrastructure, healthcare and development of financial institutions for infrastructure - all this will also inevitably lead to the revival of MSMEs.”